Business succession in the skilled crafts sector is a significant challenge, with at least 125,000 family businesses looking for a successor in the next five years (source ZDH-Zentralverband des Deutschen Handwerks). Successful handovers require timely planning, realistic assessment and professional support.

Read shortly

- Business succession is crucial for entrepreneurs who want to hand over their business.

- Careful planning and early identification of potential acquirers are important.

- A realistic company valuation is essential for successful negotiations.

- Suitable successors with entrepreneurial skills are of great importance for the successful continuation of the German skilled crafts sector.

- Craft enterprises have specific contact points for support.

- Timely planning ensures a smooth transition.

- Clever tax planning saves costs.

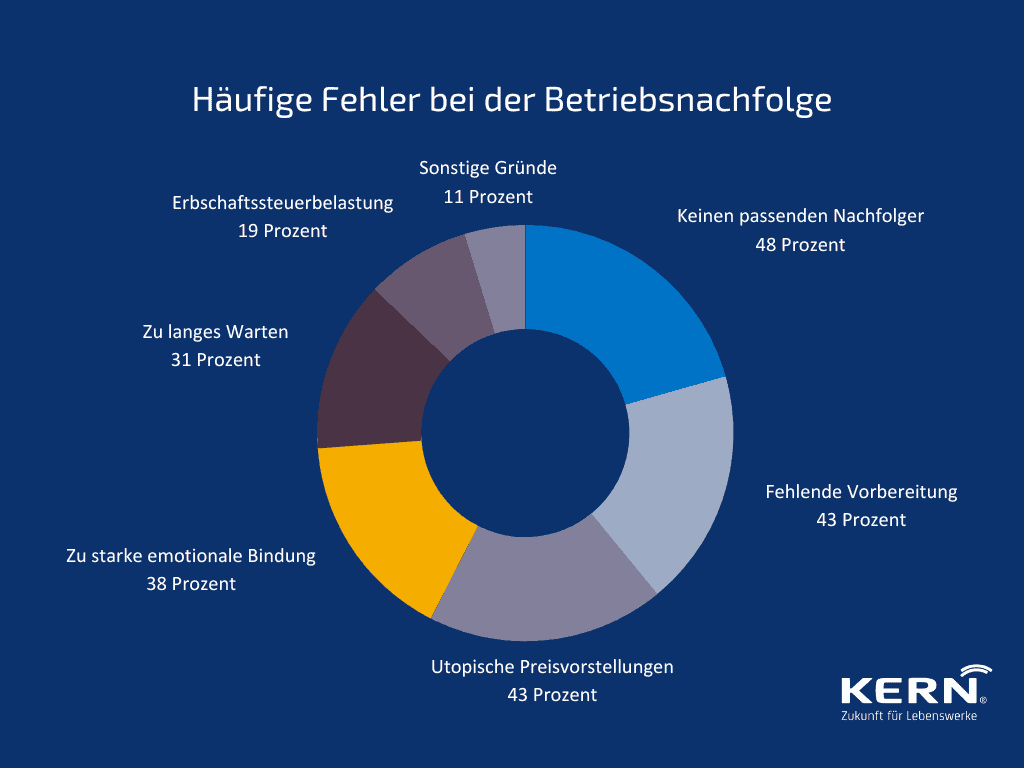

- Common mistakes: unsuitable transferees, overestimation of the company’s value, structural problems in the business.

The business succession at a glance

Business succession is an important step for every entrepreneur who wants to pass his or her business into good hands. There are various ways to organise this process. A central aspect is the search for a suitable successor for the business.

The first step in succession is careful planning. This involves formulating one’s own vision for the future of the business and determining when and to whom the handover should take place. It is important to identify potential successors at an early stage and to approach possible candidates confidentially.

A further step is to calculate the value of the business. Here it is of great importance to realistically assess the value of the business and thus create a fair basis for negotiations with potential acquirers. Factors such as turnover development, customer base, employees, tangible and intangible assets play a role here.

The search for a suitable business successor is often a complex task. In addition to internal succession, in which an employee or a family member takes over the business, an external takeover can also be considered. In this case, interested parties, investors or other companies can be potential takeover candidates. Often from the direct competitive environment.

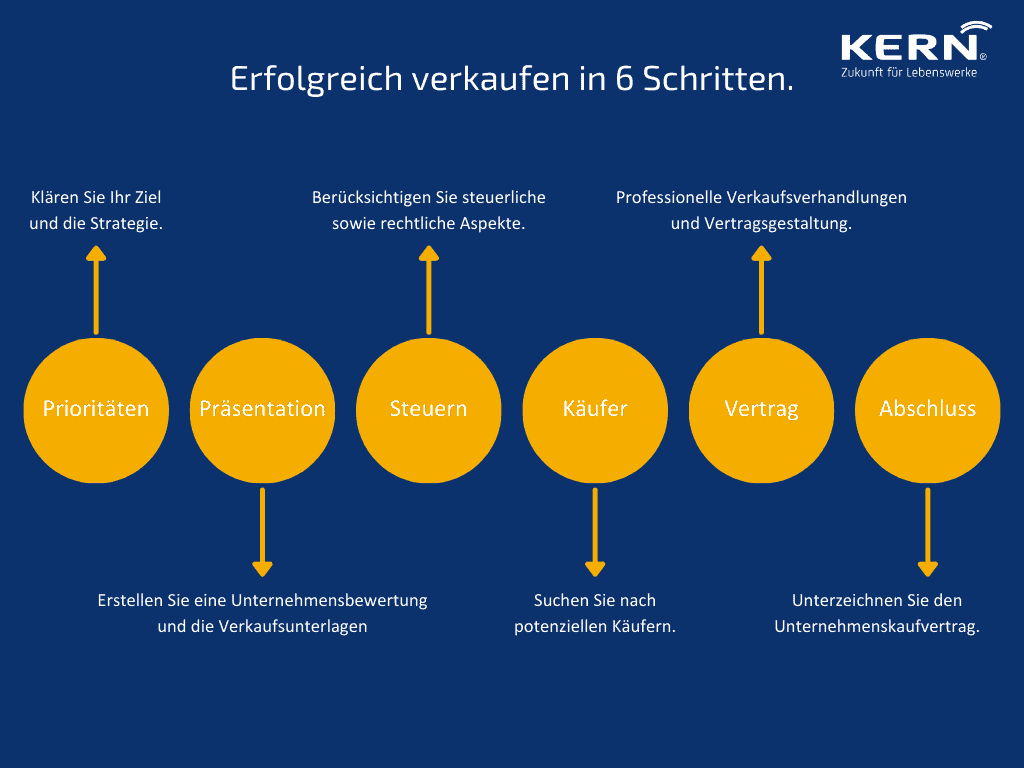

Once a suitable successor has been found, the handover process begins. Here, all the details of the handover are clarified, such as the timing, the contractual modalities and the transfer of responsibility. A careful handover is crucial to ensure the smooth continuation of the business.

For craft enterprises in particular, there are specific contact points and advice centres (HWK) that can provide support with business succession. These offer information on legal and tax issues, but also on financing options and funding programmes for successors.

Overall, business succession is an extensive process that requires thorough planning and preparation. By addressing the issue in good time and involving experts, a successful handover of the business can be ensured.

Determine operating value: What is your business worth?

Business valuation plays a decisive role in the preparation of a business handover in the context of succession. Because before it comes to handing over the business into new hands, it is important to determine the value of the business. This value forms the basis for further steps and negotiations in the entire process.

However, determining the farm value can be a complex matter. There are various ways and methods to determine the value of the business. Factors such as turnover, profit, customer base, employees and material assets flow into the valuation. In the skilled crafts sector, the so-called AWH method has gained a good reputation (AWH=Arbeitskreis der Wert ermitteln Berater im Handwerk). For larger businesses, the capitalised earnings method makes sense.

Before a business is handed over, it is therefore advisable to deal intensively with this topic. Careful preparation and a realistic assessment are essential for a successful succession.

To help entrepreneurs determine the value of their business, KERN offers a free business value calculator online. With this tool, owners can get a first insight (rough estimate according to the multiple method) into the potential value of their business and gain valuable thoughts for the further steps towards handing over the business.

Regardless of whether you are already actively considering a business succession or are only in the initial phase, a sound business valuation sets the conditions for a successful handover. The company value calculator from KERN offers helpful support on the way to a successful succession.

Let’s talk about valuing your business in a free initial consultation.

3 tips for business succession in the skilled crafts sector

A successful Business succession in the skilled crafts sector requires careful planning and professional support from platforms (e.g. DUB.de), contact points (business development agencies) and chambers of crafts.

Professional support is indispensable

The Company succession in the skilled crafts sector is a major challenge that requires careful planning and targeted measures. In order to make the process successful, professional support is indispensable. Here, specialised platforms, contact points and chambers of crafts play an important role in bringing together both business owners and potential successors and making the transition smooth.

Platforms and contact points

Here are some important platforms and contact points at a glance:

Nexxt-Change: Nexxt-Change is a platform operated by the Association of German Chambers of Industry and Commerce (DIHK). It is aimed specifically at entrepreneurs who are looking for a successor for their company or who would like to take over a business themselves. The platform offers a database with requests and offers for business succession and enables a targeted search for suitable partners free of charge.

The German Enterprise Exchange: DUB is an online platform that supports business sales and business successions. Both offers to buy and sell businesses can be found here. The platform offers a wide selection of different industries and is also an interesting place for craft businesses to find potential successors. The advertisements are of high quality overall and are often accompanied by professional advice. This ensures speed and reliability.

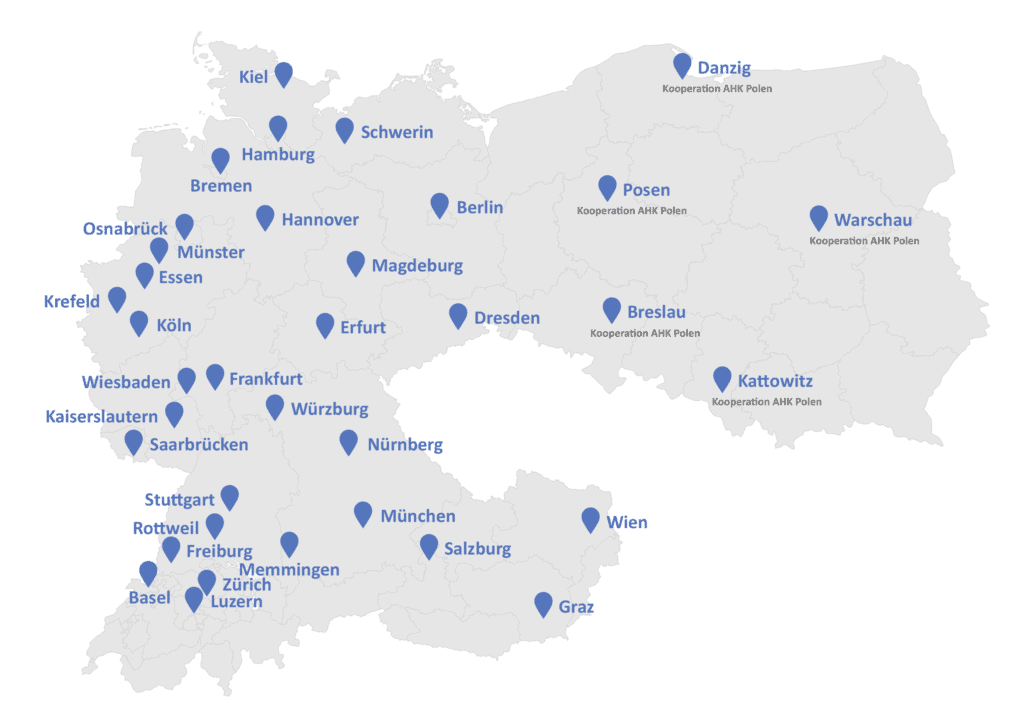

KERN Business Succession: KERN is the consulting firm in the entire DACH region that has specialised solely in assisting with company successions for a good 20 years. In addition to consulting services, KERN also offers a company exchange where owners can discreetly put their businesses up for sale. At the same time, KERN supports successors in their search for a suitable company to take over.

On the KERN Company Exchange you will find a large number of verified advertisements from buyers and sellers.

Chambers of Crafts: The Chambers of Skilled Crafts are important contact points for skilled craftsmen dealing with the topic of business succession. They offer advice and information on legal, tax and organisational aspects of succession. In addition, the Chambers of Skilled Crafts often have a broad network of potential successors and can assist in finding them. Often they also prepare value assessments for craft enterprises according to the AWH procedure.

Using these platforms and contact points can considerably facilitate and accelerate the search for a suitable successor for your craft business. Use the variety of these options to realise a successful business succession.

Plan business succession in the skilled crafts sector in good time

Early planning is crucial for a smooth business succession. Give yourself enough time to find potential successors and carefully prepare the handover process. Consider which qualifications and characteristics a successor for your craft business should have and what goals you have for the future of the business. The better you define your ideas and requirements, the more specifically you can search for a suitable successor.

Skillfully save taxes

Skilful tax planning can bring considerable savings when it comes to business succession in the skilled crafts sector. Therefore, consult an experienced tax advisor early on (at least 2-3 years before a sale) who will inform you about tax aspects and structuring options. Through a forward-looking tax strategy, you can optimise your financial situation and make the takeover of the craft business more attractive for the successor.

Common mistakes in business succession

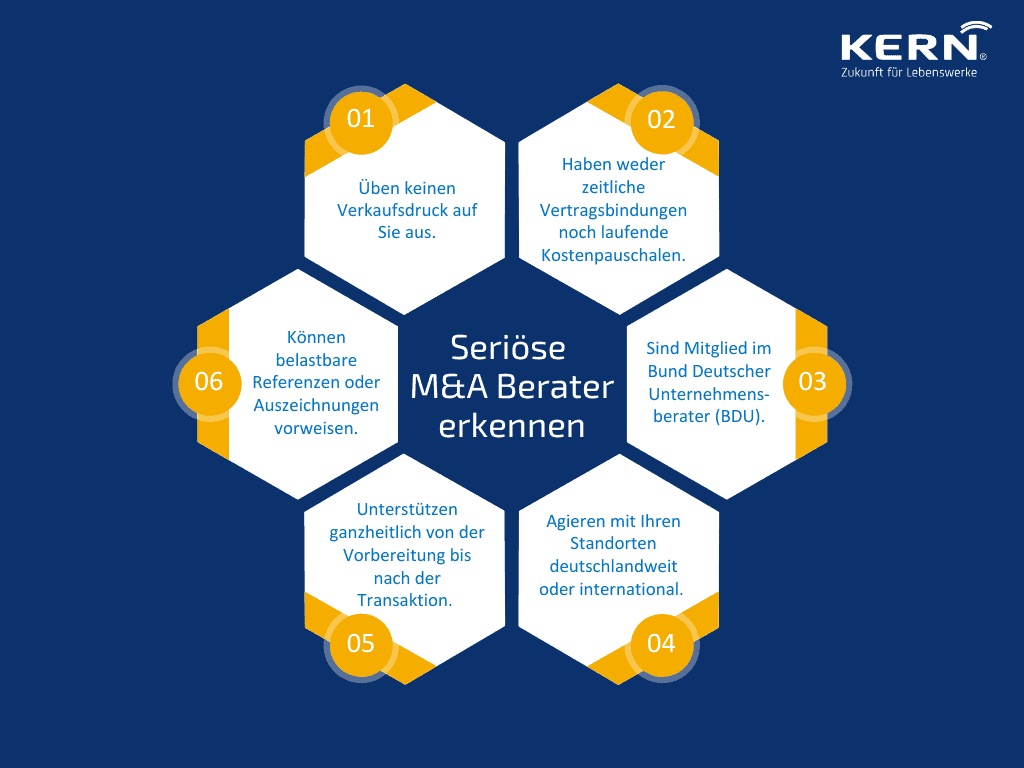

Common mistakes in business succession include selecting unsuitable successors, overestimating the value of the business due to emotional attachment, and discovering fundamental structural problems in the business that require external advisors.

Successor is not a suitable entrepreneur

One of the crucial mistakes is to choose an unsuitable successor. It is important that the chosen successor not only has the professional competence, but also has entrepreneurial skills. A suitable successor should be able to successfully continue and develop the business. There are online portals for this, for example, such as My Entrepreneur Checkwhich use an online assessment and advisory coaching to test the potential for entrepreneurship and identify development opportunities.

Company value is overestimated

Another common mistake is overestimating the value of the business. Understandably, owners have an emotional attachment to their life’s work and tend to overestimate the value of the business. A realistic business valuation by experts is crucial to determine the actual market value and to conduct objective negotiations with the successor or acquirer.

Operation is fundamentally not capable of succession

Sometimes it becomes apparent in the course of succession planning that the business has fundamental structural problems that make a successful transfer of the business difficult or impossible. In such cases, it may be advisable to involve external advisors at an early stage in order to make necessary adjustments or to examine alternatives.

Conclusion

Successful business succession in the skilled crafts sector requires thorough planning and professional support. By addressing the challenges early on and relying on the professional support of platforms, contact points and chambers of skilled crafts, entrepreneurs can ensure that their life’s work continues in good hands and that the transition goes smoothly.

Start with an initial confidential value assessment.