Company Exposé

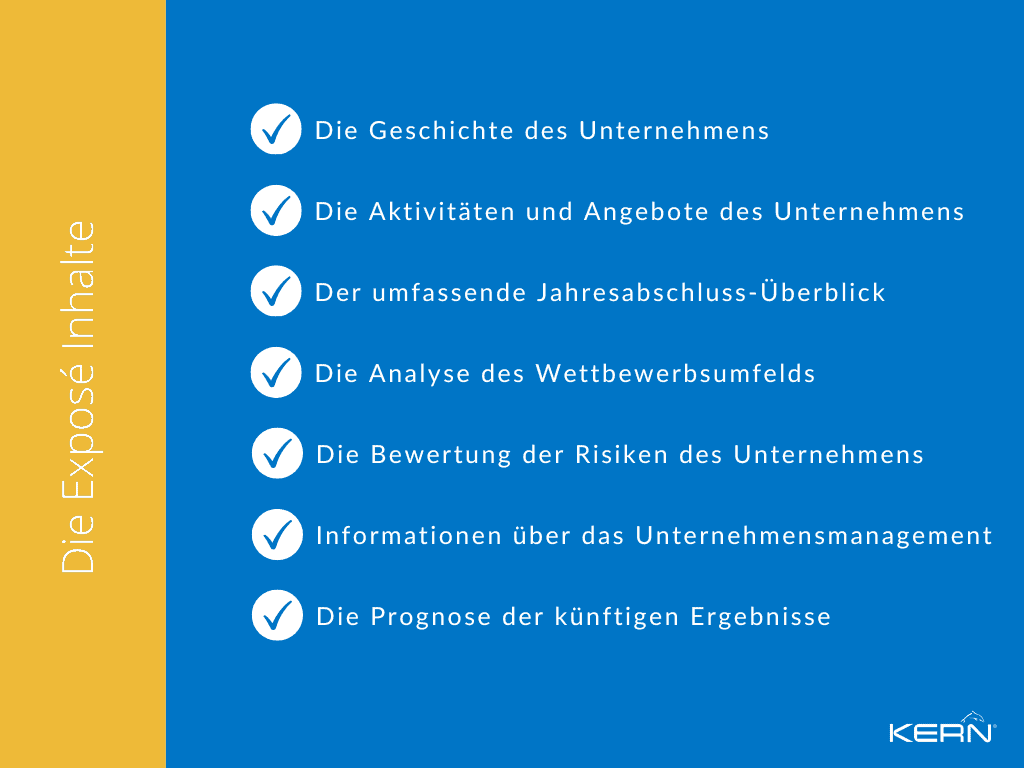

An exposé for the sale of a business contains, depending on the industry and focus, information about:

An exposé ? also Information Memorandum called ? is an important document in order to Information important for the initial assessment by a prospective buyer about your company in an attractive setting. In addition to information about the business model and products or services, you will also find Information on history, staff, organisation and, of course, finances.

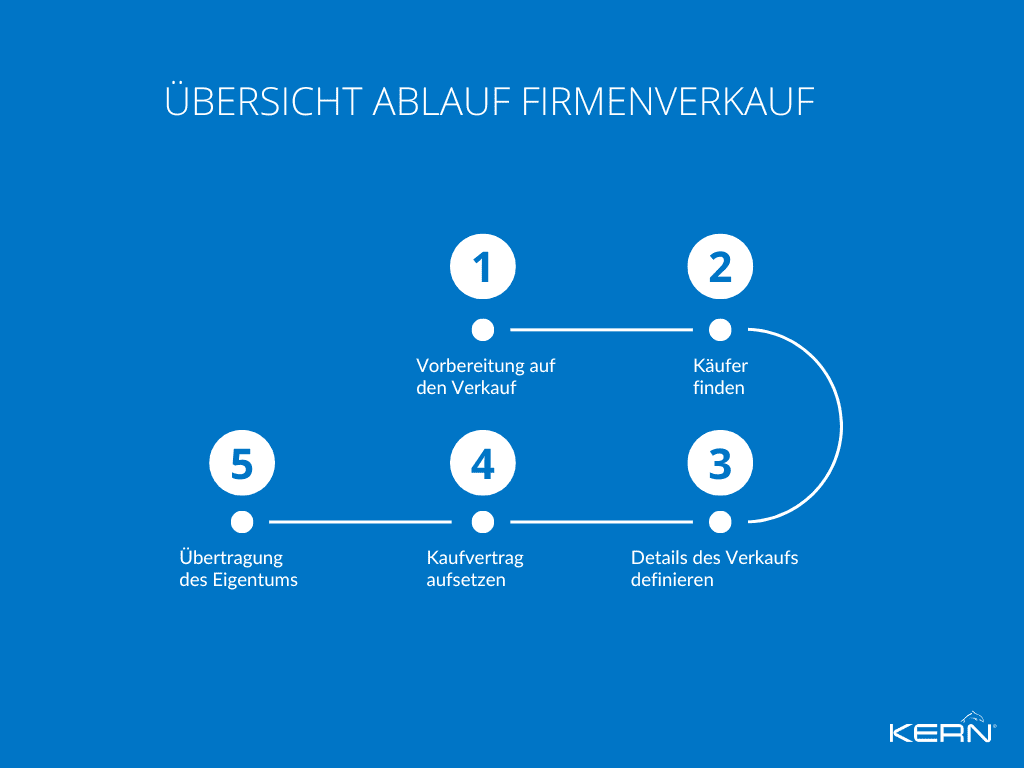

Company sale procedure

Selling a business can be a complex and lengthy process involving many steps. Read a brief overview of the process here:

Preparation for the sale

The first step in the sale of a company is the Preparation for the sale. This includes, for example, the company valuation and the determination of an appropriate asking price. The company exposé also falls into this phase. The most important question: What do you want to sell, how and when?

Find buyers

Once the business is ready for sale, the next step is to find a buyer. This can be done via a M&A advice, an online business exchange or through lengthy referrals happen.

Define details of the sale

Once a buyer is found, the seller and buyer work on the details of the sale, including the Negotiating a purchase price, agreeing payment terms and the important Due Diligence Examination.

Draw up purchase contract

Once the sale is agreed, the buyer and the seller must draw up a contract of sale. This should contain details of the price, the Terms of payment, guarantees and other important information contain.

Transfer of ownership

The final step of the process is the closing of the sale. This includes the Transfer of ownership in the company and its assets to the purchaser, the payment of the purchase price as well as all Conditions attached to the purchase and the Registration of the new shareholders/owners with the competent authority.

These 5 buyer types exist in business succession

First the confidentiality agreement, then the exposé

The exposé is sent to selected and pre-screened interested parties. only after signing a confidentiality agreement (NDA) made available to you. As the seller, you always decide on a case-by-case basis who may view your exposé. An anonymous short profile of the company is also created in advance for the exposé. This serves as a direct initial contact with interested parties and protects your company from being identified by potential buyers. This procedure ensures that the Confidentiality of confidential information ensured as far as possible.

Definition exposé for company sale

An exposé ? also

Information Memorandum called ? is an important document in order to Information important for the initial assessment by a prospective buyer about your company in an attractive setting. In addition to information about the business model and products or services, you will also find Information on history, staff, organisation and, of course, finances.

What is the purpose of a company exposé?

The business sale exposé should be a complete and thorough document. It should provide potential buyers or investors with all the information they need to make an informed decision.

Prepare for sale with the exposé

Preparing for the sale of a business is a complex process that requires careful planning to maximise success. To ensure a successful outcome, it is important to prepare a well-developed business sale exposé.

When preparing an exposé on the Company sale it is important to consider the target group. Investors and potential buyers need to understand the strengths and weaknesses of the company, so it is important to explain these in an organised and professional manner.

For buyers: You will receive an informative company exposé after you have found an interesting object. Feel free to register here with your search profile and find your dream project in corporate purchasing:

If you are an MBI, strategic investor or financial investor looking to buy a company or acquire a stake, you will receive direct access to the free registration of your search profile here.

Research and presentation of the relevant data

The message of the exposé should be tailored to the target audience and clearly explain the advantages of the company, for example:

A detailed description of the company, including its strengths and weaknesses

An overview of the current performance of the company’s business model

A market analysis to identify potential opportunities and risks

A competitive analysis to identify potential threats and advantages

An analysis of the company’s customer base

Proposals for the development of the company’s current business model

Analysis and presentation of the economic figures

The company exposé should not only give a general overview of the company, but also include details of the company’s financial data. This includes a balance sheet, a Profit and loss account, a cash flow statement and any other financial information that might be useful to potential buyers. Often in an abbreviated overview of the last few years.

It is also important to list the assets and liabilities of the business, including any debts and equity.Company sales exposé: An important building block for arousing interest

A good, informative exposé is an important building block for approaching prospective buyers and at the same time helps to arouse interest in your business. How can I get a potential buyer interested in my business? What distinguishes my company and what makes them attractive? These points need to be clearly worked out and carefully documented. This also includes professional photos, for example of the products or the company building.