Company acquisition: everything you need to know in 2025

Ein Unternehmenskauf ist eine große Entscheidung. Es gibt viele verschiedene Faktoren, die berücksichtigt werden müssen, bevor man sich für einen Kauf entscheidet. Wie sieht der Ablauf aus? Welcher zeitliche Rahmen sollte eingeplant werden? Wo lauern Fallstricke bei der Finanzierung? Wir erklären Ihnen alles, was Sie in Sachen Unternehmenskauf wissen sollten!

Warum der Unternehmenskauf einfacher, lukrativer und spannender ist, als selbst zu gründen

Kaufinteressenten, die auf der Suche nach dem richtigen Unternehmen sind, unterstützen wir mit unserem großen KERN-Netzwerk von der gezielten, effizienten Recherche bis hin zur erfolgreichen Übernahme (M&A). Wir sind mit den wichtigsten Börsen verbunden und pflegen über 500 direkte Kontakte zu Banken in der D-A-CH-Region. So ermöglichen wir anorganisches Wachstum sowie die Umsetzung Ihrer unternehmerischen Vision.

Start video

Wie Ihr Unternehmenskauf zum Erfolg wird. Der Experten-Ratgeber für Familienunternehmen.

Geballte Kompetenz und kompakte Informationen. 25 KERN-Experten haben für Sie auf 200 Seiten die wichtigsten Informationen für Ihren erfolgreichen Unternehmenskauf (M&A) zusammengefasst.

Company acquisition checklist (PDF)

The Corporate transaction kann auf den ersten Blick ein erschlagendes Unterfangen sein. Dies muss aber nicht so bleiben, wenn Sie professionelle Unterstützung erhalten.

Für die Käuferprüfung (dd = due diligence) nutzen Sie hier unsere Gratis-Checkliste, die Ihnen auszugsweise einen ersten Überblick über die zu prüfenden Unterlagen gibt.

Unternehmenskauf (M&A) mit Unterstützung unseres KERN-Netzwerkes

Präzises Suchprofil

Erstellung eines maßgeschneiderten Profiles für die gezielte Suche nach geeigneten Unternehmen.

Gezielte Käuferansprache

Ansprache relevanter Firmen und Multiplikatoren wie Kammern, Banken und Berater. Annoncierung in den renommiertesten M&A-Börsen.

Selection

Identifikation, Analyse und Auswahl geeigneter Zielunternehmen. Diskrete Direktansprache und Prüfung der Verkaufsbereitschaft.

Negotiation financing partner

Verhandlungen und Integration von unterschiedlichsten Finanzierungspartnern für den Unternehmenskauf.

Due Diligence

LOI Umsetzung sowie Vorbereitung und Durchführung der Unternehmensprüfung (DD), Verhandlung und Abschluss des Company purchase agreements.

Post Merger Integration

Optional Post Merger Integration (PMI). Aftercare for corporate development, such as integration of teams, synchronisation of mission statements.

Denken Sie über den Kauf eines Unternehmens nach?

Nutzen Sie die Chance, von unserer langjährigen Erfahrung in der Unternehmensnachfolge zu profitieren. Ob Sie erste Fragen haben oder bereits gezielt nach einem passenden Unternehmen suchen - KERN begleitet Sie kompetent durch den gesamten Prozess.

As buyers, we can give KERN unreserved, unqualified praise!

In 2020, we took over Wink GmbH in the Augsburg area as an investor and are very happy with it. The transaction was accompanied by Mr Greppmair from KERN, which we found to be very professional and also led quickly to the goal. Here we can offer unreserved and unqualified praise. We would be happy to work with KERN again and again!

Very much appreciated his ability to get to grips with the ins and outs of family businesses

I got to know Mr Claus in 2010 as part of an expansion project for an owner-managed company. During this time, I came to appreciate his goal-oriented approach and his ability to get to grips with the specifics of family businesses. I am happy to recommend him.

The mixture from KERN was so far unique in its kind and therefore particularly valuable

Thank you very much for your lively contribution to the BVMW event Company Succession in Practice. Mr Greppmair, you succeeded in a special way in entering the world of the audience - the entrepreneurs affected by the succession - and picking them up where they are particularly emotionally. The mixture of lecture and role play was so far unique in its kind and therefore particularly valuable.

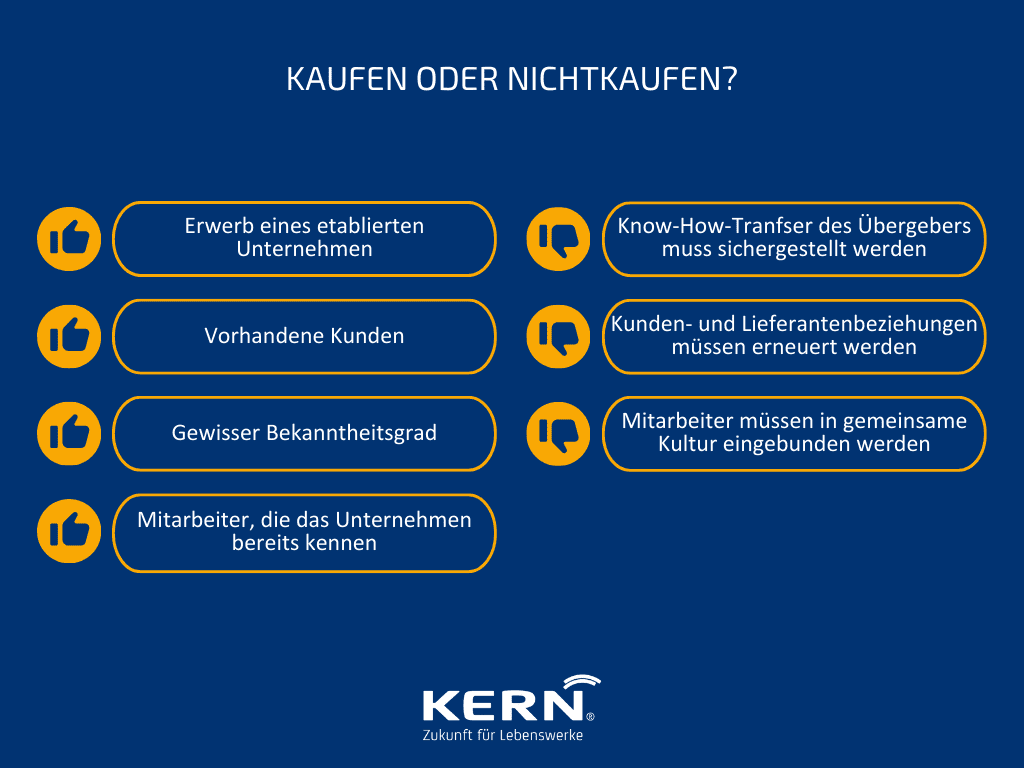

Advantages and disadvantages of buying a company

Zu den Vorteilen gehört, dass Sie ein etabliertes Unternehmen erwerben, das bereits Kunden hat und einen gewissen Bekanntheitsgrad genießt. Außerdem übernehmen Sie ein Team von Mitarbeitern, die das Unternehmen bereits kennen und wissen, wie es funktioniert.

Allerdings gibt es auch mögliche Nachteile beim Unternehmenskauf. Der Kauf eines Unternehmens ist eine große Entscheidung, die sorgfältig geprüft werden sollte. Vor allem sollten die Risiken des Kaufs abgewogen werden. Kann ich als Käufer den wichtigen Know-How-Transfer des Übergebers sicherstellen? Bleiben Kunden- und Lieferantenbeziehungen intakt und kann ich die Mitarbeiter in eine gemeinsame Kultur und Zukunft einbinden?

Are you an entrepreneurial type?

Bevor Sie sich für den Kauf eines Unternehmens entscheiden, sollten Sie sich zunächst die Frage stellen, ob Sie der passende Unternehmertyp sind. Denn nicht jeder ist für den Erwerb eines bestehenden Unternehmens geeignet. Wenn Sie jedoch folgende Eigenschaften mitbringen, dann stehen die Chancen gut, dass Sie ein erfolgreicher Unternehmenskäufer werden:

- You are entrepreneurial in thinking and acting

- Sie haben eine Vision und möchten diese verwirklichen zugehen

- You are creative and think out-of-the-box

- You are willing to work with commitment and take risks

- Sie gehen gerne mit Menschen um und schätzen eine klare Kommunikation

Position of interest

Die Ziele von Käufern beim Unternehmenskauf variieren:

Financial investors: Fokus auf hohe Renditen in 5–8 Jahren, meist mit Weiterverkauf.

Strategic investors: Long-term development and integration of the company.

Company successor: Familienunternehmen bieten durch den Generationswechsel viele Chancen, ein Unternehmen zu „leben“ und kulturell zu übernehmen.

Wichtig ist, ein Unternehmen zu finden, das zu Ihrer Größe, Ihrem Geschäftsmodell und Ihrer Unternehmenskultur passt.

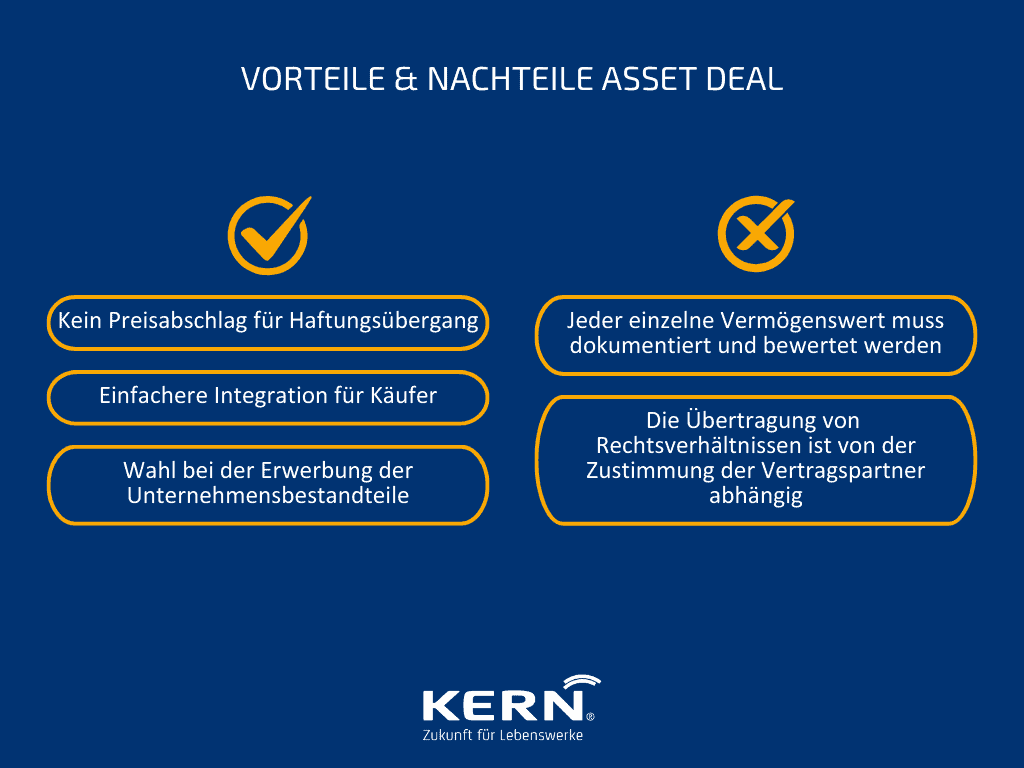

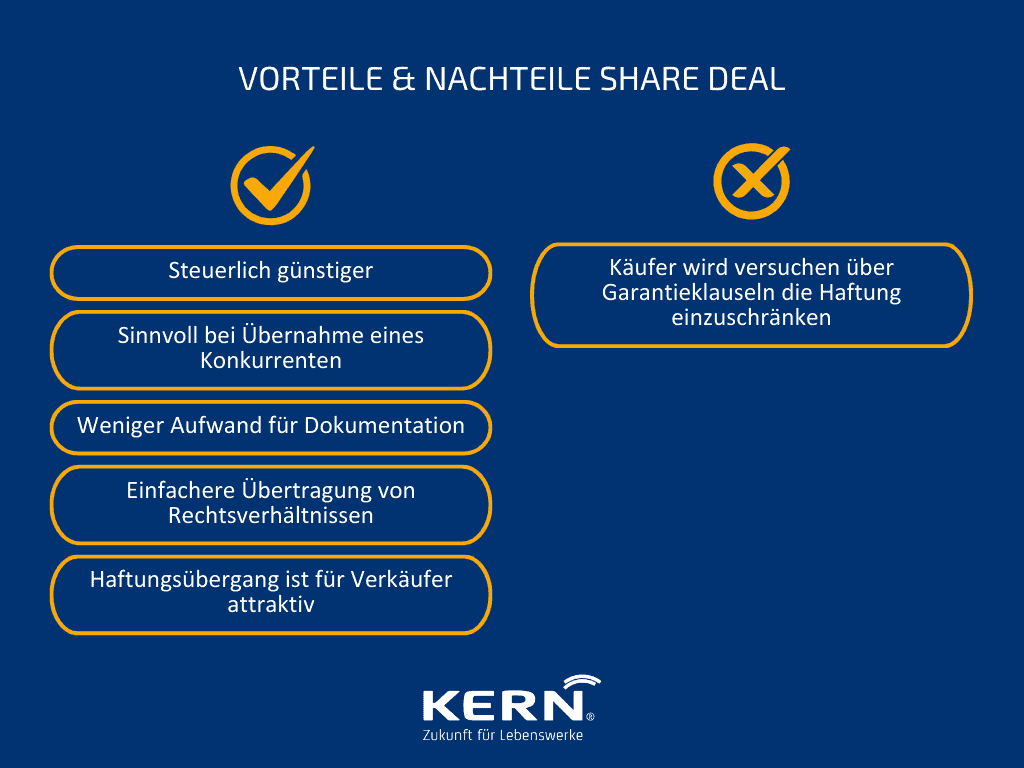

Formen der Übernahme

Es gibt verschiedene Formen der Übernahme eines Unternehmens. Grundsätzlich ist eine Unterteilung in Asset Deal (Verkauf der einzelnen Bestandteile einer Unternehmung) sowie Share Deal (Verkauf eines gesellschaftsrechtlichen Rahmens) sinnvoll.

Asset Deal

Ein Asset Deal ist eine Transaktion, bei der nur die Aktiva des Unternehmens verkauft werden. Dies bedeutet, dass der Käufer nur die Vermögenswerte des Unternehmens erwirbt, aber nicht die Haftung für Verbindlichkeiten übernimmt. Dies ist ein gängiges Vorgehen bei Firmenkäufen, da es dem Käufer ermöglicht, das Risiko zu minimieren, das mit der Übernahme eines Unternehmens verbunden ist. Es kann auch das bewusste Ziel des Verkäufers sein, weil steuerliche und juristische Überlegungen die Gesellschaft lieber beim Übergeber belassen.

Share Deal

A Sell limited liability company per Share Deal ist eine Übernahme, bei der das Unternehmen oft als Ganzes gekauft wird. Das bedeutet, dass der Käufer die vollständigen Anteile des Unternehmens erwirbt und somit die Kontrolle über das Unternehmen erlangt. Dabei bleibt das Unternehmen als rechtlich eigenständige Organisation bestehen. Der neue Eigentümer erhält jedoch nicht nur die Anteile an der Gesellschaft, sondern damit auch die Kontrolle über das Unternehmen.

Shareholder können auch nur Sell GmbH shares. Der Einfluss des neuen Eigentümers der Anteile hängt hierbei von den Eigentumsverhältnissen und der Höhe der Anteile ab.

Difference between asset deal and share deal

Um es auf den Punkt zu bringen: Beim Asset Deal werden nur die Aktiva des Unternehmens verkauft, während beim Share Deal auch die Geschäftsanteile übertragen werden. Dieser Unterschied ist wichtig, da er sich auf die Haftungsrisiken und möglicherweise auch auf Kunden- und Lieferantenbeziehungen auswirkt. Um alle Unterschiede im Detail zu betrachten, empfehlen wir unseren Beitrag Share Deal vs. Asset Deal.

Types of company purchase

There are different types of Company acquisition, die sich auf die Art und Weise des Kaufs, die Preisgestaltung und die Konditionen des Kaufs beziehen. Einige der häufigsten Arten eines Firmenkaufs sind: Management Buy Out (MBO), Management Buy In (MBI) und Leveraged Buy Out.

Management Buy Out (MBO)

A Management Buy Out (MBO) ist eine Methode, bei der das bestehende Management eines Unternehmens die Kontrolle über das Unternehmen übernimmt. In einem MBO kauft das Management das Unternehmen von den bisherigen Eigentümern und wird zum neuen Eigentümer. Das hat den Vorteil, dass sich alle Akteure häufig über Jahre kennen, allen die Strukturen und Details der Unternehmung bekannt sind und die Mitarbeiter den Nachfolger bereits gut kennen.

Management Buy In (MBI)

Ein Management Buy In (MBI) ist eine Art des Unternehmenskaufs, bei der eine Einzelperson (oder mehrere Personen, fast analog einer Gründung) Anteile an dem zu erwerbenden Unternehmen kauft. Die Lösung der Company succession mit einem MBI ist die klassische Nachfolgelösung und kommt sehr häufig bei kleineren Unternehmungen vor. Das Einbringen von externem Wissen und Know-how durch den MBI und damit nachfolgenden Unternehmer kann dazu beitragen, den Übergang zu einer neuen Strategie zu erleichtern und das neue Unternehmen auf Erfolgskurs zu bringen.

The MBI Financing ist häufiger schwierig, da je nach Kaufpreisvolumen ausreichend eigenes Kapital für eine Kaufpreisfinanzierung vorhanden sein sollte und Banken skeptisch bei einem zu geringen Eigenkapitalanteil werden. Daher muss ein MBI in der Lage sein, einen guten Businessplan vorzulegen und die notwendigen Mittel auf andere Weise zu beschaffen.

Leveraged Buy Out (LBO)

A Leveraged buy-out ist eine Art von Unternehmenskauf, bei dem ein Käufer einen sehr gewichtigen Teil des Kaufpreises mit Krediten finanziert und das Unternehmen selbst erweitert auch Kreditmittel aufnimmt. Dies ermöglicht es dem Käufer, einen größeren Anteil des Unternehmens zu erwerben, als es sonst möglich wäre.

LBOs können für Käufer attraktiv sein, da sie die Möglichkeit bieten, ein Unternehmen zu erwerben, ohne alle Mittel aufbringen zu müssen. Sie können auch dazu führen, dass sich das Verhältnis von Eigen- und Fremdkapital im Unternehmen verändert, was das Unternehmen anfälliger in kritischen Marktsituationen macht.

LBOs sind jedoch mit Risiken verbunden. Zum Beispiel kann es schwierig sein, Kredite zu erhalten, um einen LBO durchzuführen. Darüber hinaus können die hohen Schuldenlasten, die durch einen LBO entstehen, dazu führen, dass das Unternehmen in Schwierigkeiten gerät, wenn die Geschäfte nicht so gut laufen wie erwartet.

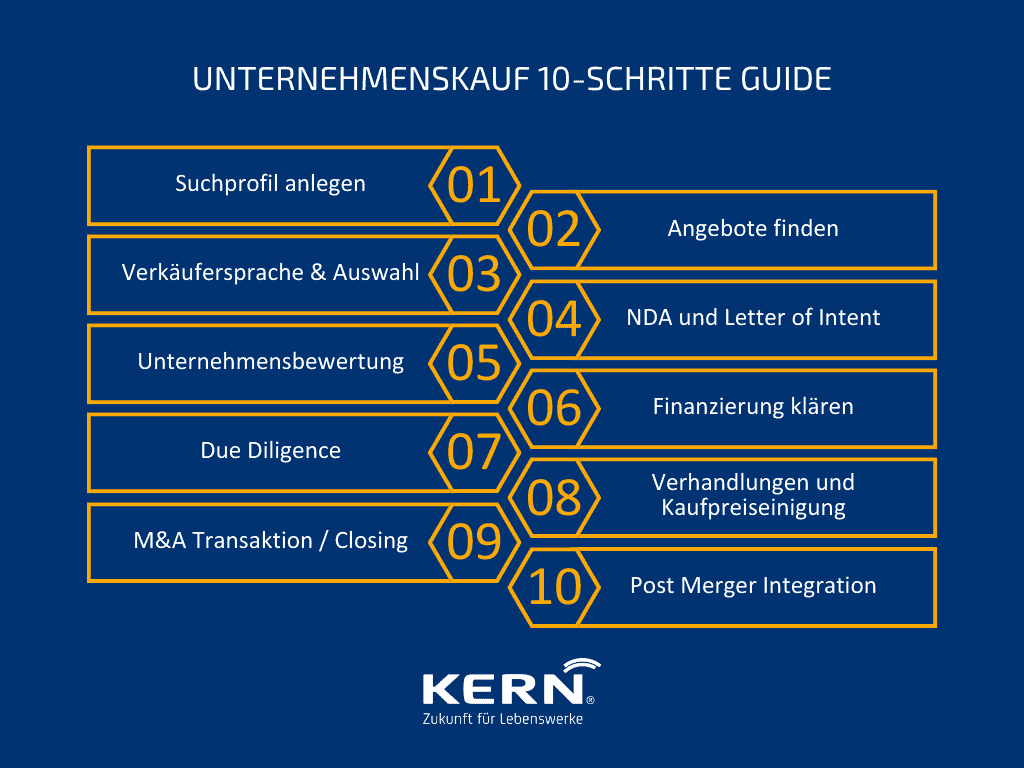

Company acquisition process - Our guide in 10 steps

Wenn Sie sich dafür entscheiden, ein Unternehmen zu kaufen, gibt es einige Dinge, die Sie im M&A process beachten sollten. Zunächst müssen Sie den Kaufprozess verstehen. Die folgenden Absätze erläutern den typischen Verlauf eines Unternehmenskaufs. Der erste Schritt beim Unternehmenskauf ist die Suche nach einem geeigneten Zielunternehmen. Dies kann eine Herausforderung sein, da es unübersichtlich viele verschiedene Unternehmen gibt und nicht alle für den Kauf geeignet sind. Ihren persönlichen Fahrplan zum Unternehmenskauf können Sie der Outline of the procedure take out.

Create search profile

Vor allem, wenn Sie ein Unternehmen kaufen möchten, ist es wichtig, ein Suchprofil in renommierten Börsen anzulegen. Durch das Anlegen eines solchen Profils können Sie sich selbst zugleich besser kennenlernen und erfahren, welche Art von Unternehmen am besten zu Ihnen passt. Außerdem können Sie mithilfe eines konkreten Suchprofils schneller die richtigen Kontakte knüpfen und so den Kauf eines Unternehmens beschleunigen. Hier sollte besonders die Weisheit “ Wer alles können will, kann gar nichts” beachtet werden.

Dieses Profil sollte Ihre Präferenzen und Kriterien für den idealen Unternehmenskauf enthalten. Zu den Kriterien gehören:

- Die Art des Unternehmens, das Sie kaufen möchten

- Die Größe des Unternehmens

- The location of the company

- Das Budget, das Sie für den Kauf des Unternehmens bereit sind zu zahlen bzw. das erforderliche Eigenkapital aufbringen können

Find company sale offers

Egal, ob Sie Ihr Unternehmen selbst kaufen oder einen externen M&A-Spezialisten beauftragen möchten – die Suche nach dem richtigen Angebot ist ein wesentlicher Bestandteil des Kaufprozesses. Um einen erfolgreichen Kauf zu gewährleisten, sollten Sie sich gut vorbereiten und sicherstellen, dass Sie alle relevanten Fragen zusammenstellen, bevor Sie mit der Suche nach dem richtigen Angebot beginnen. Es gibt verschiedene Orte, an denen Sie nach Angeboten für den Unternehmensverkauf Ihres Unternehmens suchen können.

Unternehmensbörsen

Viele Unternehmer sind auf der Suche nach einem geeigneten Käufer für ihr Unternehmen. Eine Möglichkeit, potenzielle Käufer zu finden, ist der Weg über eine Unternehmensbörse. Hier werden Unternehmen vermittelt, die zum Verkauf stehen. DUB, Nexxt Change und KERN Company exchange sind einige der größten, seriösen und bekanntesten Börsen. Viele Menschen sehen in den Börsen eine aktive und breit angelegte Möglichkeit, ein Unternehmen zu verkaufen oder zu kaufen.

Weitere Möglichkeiten außerhalb von Börsen

Das ist die berühmte Stecknadel im Heuhaufen und bedarf in der Regel besonderer Kenntnisse und den Zugang zu Datenbanken. Schließlich hängt kein Unternehmer, ähnlich wie bei Immobilien, ein Schild „Zum Verkauf“ vor seine Firmentür.

Wir haben für die Unternehmensübernahme und die erfolgreiche Identifizierung von Firmen mehrere Optionen ausgearbeitet. Sie finden diese unterschiedlichen Möglichkeiten in unserem Fachbeitrag zum Thema Target Scouting.

Verkäuferansprache und Auswahl

Sie sollten potenzielle Verkäufer nicht aufgrund des Preises auswählen, sondern das Geschäftsmodell verstehen und perspektivisch entwickeln können. Dies erfordert eine gute Kommunikation zwischen Verkäufer und Käufer, um sicherzustellen, dass beide Seiten die Erwartungen kennen und verstehen.

Es beginnt bereits bei der Auswahl der passenden Kaufobjekte und der ersten Kontaktaufnahme mit dem jeweiligen Verkäufer. Auf diese Weise wird mit einem ersten guten Auftritt auch der erste Schritt zu einer erfolgreichen Transaktion gemacht.

NDA and Letter of Intent

The NDA and the Letter of Intent are two of the most important documents involved in the purchase of a company.

A non-disclosure agreement (NDA) is a legal document that prevents confidential information from being shared. This document is usually signed between two parties before they start negotiating or exchanging data.

A Letter of Intent (LOI) ist ein Dokument, das die Absichten einer oder mehrerer Personen in Bezug auf eine Vereinbarung oder ein Geschäft darlegt. Es ist keine rechtsverbindliche Vereinbarung, sondern dient vielmehr dazu, die Verhandlungen zwischen den Parteien zu erleichtern und zu beschleunigen. Der Letter of Intent kann auch verwendet werden, um die wesentlichen Bedingungen einer künftigen Vereinbarung festzulegen.

Ebenfalls unerlässlich: Das Information Memorandum enthält detaillierte Informationen über das Unternehmen, seine Geschäftstätigkeit und seine Finanzlage. Ziel eines Information Memorandum ist es, potenziellen Investoren einen umfassenden Überblick über das Unternehmen zu geben, damit diese entscheiden können, ob sie in das Unternehmen investieren möchten.

Business valuation

The Business valuation ist ein wesentlicher Bestandteil des Kaufprozesses. Die Bewertung eines Unternehmens erfolgt in der Regel durch einen unabhängigen Finanzexperten und basiert auf verschiedenen Faktoren wie dem aktuellen und zukünftigen Ertragspotenzial, dem Wettbewerbsumfeld, den Marktchancen sowie der finanziellen Situation des Unternehmens. Aufgrund dieser Faktoren kann die Bewertung eines Unternehmens sehr unterschiedlich ausfallen.

Nachfolgenden zwei Absätze alsnInfobox zur “Fairness Opinion”

An important aspect when you consider the Calculate enterprise value wollen, ist die sogenannte “Fairness Opinion”. Dabei handelt es sich um eine Stellungnahme eines unabhängigen Dritten, in der bestätigt wird, dass der Preis für das Unternehmen fair ist.

Um eine Fairness Opinion zu erhalten, muss das Unternehmen einen Experten beauftragen. Dieser wird dann eine Untersuchung durchführen und seine Stellungnahme abgeben. In der Regel ist die Fairness Opinion Teil des Berichts des Experten.

Finanzierung klären

Eine solide Finanzierungsstrategie ist entscheidend für einen erfolgreichen Unternehmenskauf. Klären Sie im Vorfeld:

Welche Finanzierungsmöglichkeiten passen zu Ihnen (Eigenkapital, Kredit, Verkäuferdarlehen)?

Wie viel Kapital benötigen Sie, einschließlich der Wachstumsphase?

Welche Kreditgeber oder Förderprogramme kommen infrage?

Finanzierungsoptionen im Überblick:

Credits: Banken und Sparkassen bieten klassische Finanzierungsmöglichkeiten.

Investors: Externe Geldgeber können strategisch oder finanziell interessiert sein.

Verkäuferdarlehen: Ein Teil des Kaufpreises wird direkt vom Verkäufer finanziert.

Earn-Out: Zahlung eines Kaufpreisteils bei späterer Zielerreichung. Lesen Sie dazu auch unseren Fachartikel zum Thema Earn-Out.

Förderungen: KfW-Programme oder regionale Fördermittel helfen bei der Finanzierung.

Beraten Sie sich frühzeitig mit Steuer- und Finanzexperten, um die beste Finanzierungsstrategie zu entwickeln. Planen Sie dafür mindestens 8 Wochen ein, bei komplexeren Vorhaben bis zu 3–4 Monate.

Due Diligence

The Due Diligence ist ein wesentlicher Bestandteil des Unternehmenskaufs. Es beinhaltet die Prüfung der finanziellen Unterlagen und Geschäftsprozesse des Unternehmens, um sicherzustellen, dass es für den Käufer eine gute Investition ist und die bisher gemachten Angaben des Verkäufers auch tatsächlich der Realität entsprechen.

Nachfolgenden Absatz als Infobox zur “Due Diligence Checkliste”

Die Due Diligence wird normalerweise von einem Team aus Experten durchgeführt, die in verschiedenen Bereichen des Unternehmens Erfahrung mitbringen. Als Orientierung für die entscheidenden Elemente der Due Diligence haben wir eine umfangreiche Liste für Sie erstellt. Nutzen Sie unsere Due Diligence Checklist gerne für Ihren Kauf.

Legal Due Diligence and Tax Due Diligence

Die Legal Due Diligence ist ein Prozess, bei dem ein Anwalt oder eine andere externe Partei die Unterlagen des zu kaufenden Unternehmens gründlich überprüft, um sicherzustellen, dass es keine offenen Rechtsstreitigkeiten gibt und dass alle Verträge und Lizenzen in Ordnung sind.

Die Tax Due Diligence ist ein Prozess, bei dem ein Steuerberater oder eine andere externe Partei die Unterlagen des zu kaufenden Unternehmens überprüft, um sicherzustellen, dass es keine steuerlichen Risiken gibt.

Negotiations and purchase price agreement

Nachdem Sie den richtigen Käufer gefunden haben, ist es an der Zeit, die Verhandlungen zu beginnen. Die Verhandlungen sind ein wichtiger Teil der Unternehmensübernahme und können oft entscheidend dafür sein, ob der Kauf erfolgreich ist oder nicht. Es ist wichtig, dass Sie sich gut auf die Verhandlungen vorbereiten und wissen, was Sie wollen und was Sie bereit sind, zu geben.

In einem Unternehmenskauf gibt es viele verschiedene Verhandlungspunkte, aber der Preis ist natürlich einer der wichtigsten. Wenn Sie sich auf einen Preis einigen können, ist der Rest der Verhandlungen normalerweise nur noch Formsache.

M&A Transaction / Closing

Der Kauf eines Unternehmens ist ein komplexer Prozess, der sorgfältige Planung und Durchführung erfordert. Wenn Sie sich darauf vorbereiten, ein Unternehmen zu kaufen, müssen Sie einige wichtige Schritte beachten, um sicherzustellen, dass die Transaktion reibungslos verläuft.

Ein sehr wichtiger Schritt beim Kauf eines Unternehmens ist das Closing. Das Closing ist der letzte Schritt in der Transaktion und beinhaltet den Austausch von Dokumenten und Geldern zwischen dem Käufer und dem Verkäufer zur finalen Übergabe der Unternehmung.

Post Merger Integration

The Post Merger Integration (PMI) ist ein wesentlicher Bestandteil eines erfolgreichen Unternehmenskaufs. Die PMI umfasst die Planung und Durchführung aller Aktivitäten, die erforderlich sind, um sicherzustellen, dass das neu erworbene Unternehmen nahtlos in das bestehende Unternehmen integriert wird.

Ein wichtiger Aspekt der Post Merger Integration ist die Kommunikation. Um eine erfolgreiche Post Merger Integration zu gewährleisten, ist es wichtig, dass die beteiligten Unternehmen bzw. Gesellschafter und/oder Geschäftsführer eine enge Zusammenarbeit leisten und einen klaren Plan für die Umsetzung haben.

Duration of a company purchase

Wenn Sie ein Unternehmen kaufen möchten, müssen Sie sich auf einen relativ langen und komplexen M&A Prozess (mergers & acquisitions) einstellen. Der genaue Zeitrahmen hängt von vielen Faktoren ab. In der Regel dauert es zwischen sechs und 18 Monate, bis ein Unternehmenskauf abgeschlossen ist.

Legal aspects in the company purchase agreement

Im Rahmen eines Unternehmenskaufs gibt es einige rechtliche Aspekte, die berücksichtigt werden müssen. Dazu gehört zum Beispiel, welche Rechte und Pflichten der Käufer und Verkäufer im Vertrag vereinbaren. Auch die Haftungsrisiken müssen genau abgewogen werden.

Der Käufer sollte sich daher vor dem Abschluss eines Company purchase agreement get detailed information and advice.

Betriebsübergang

Beim Unternehmenskauf ist ein reibungsloser Betriebsübergang gemäß § 613a BGB entscheidend. Dieser regelt den Schutz der Arbeitnehmer, sodass bestehende Arbeitsverhältnisse mit allen Rechten und Pflichten auf den neuen Eigentümer übergehen.

Die häufigste Art ist, dass der Käufer das Unternehmen komplett übernimmt und die Mitarbeiter behält. In einigen Fällen kann es jedoch auch vorkommen, dass der Käufer nur einen Teil des Unternehmens übernimmt oder Mitarbeiter entlassen möchte.

Wenn Sie sich dafür entscheiden, ein Unternehmen zu kaufen, ist es wichtig, dass Sie sich im Vorfeld über die verschiedenen Möglichkeiten informieren und mit dem Verkäufer besprechen, welche Option für Sie die beste ist.

Übernahme bestehender Arbeitsverträge

Bevor Sie jedoch einen Arbeitsvertrag kündigen oder ändern, sollten Sie sich unbedingt mit einem Fachanwalt beraten. Denn es gibt einige Punkte, die Sie beachten müssen, um keine rechtlichen Probleme zu bekommen. In der Regel werden bei einem Unternehmenskauf alle Arbeitsverträge der bisherigen Beschäftigten mit allen Rechten und Pflichten übernommen. Dies gilt auch für tarifvertraglich geregelte Arbeitsverträge.

Allerdings können sich durch den Verkauf des Unternehmens auch Änderungen in Bezug auf die Arbeitsbedingungen ergeben, zum Beispiel hinsichtlich des Arbeitsortes oder der Arbeitszeit. In diesem Fall ist es ratsam, vorab alle notwendigen Rahmenbedingungen zu klären, damit keine belastenden Ereignisse in der späteren Umsetzung eintreten.

Übernahme bestehender Versicherungsverträge

Wenn Sie ein Unternehmen kaufen, das bereits Versicherungsverträge abgeschlossen hat, sollten Sie sich mit den Bedingungen der Verträge vertraut machen. Dazu gehört auch, herauszufinden, welche Risiken durch die Versicherung abgedeckt werden und welche nicht.

Auch wenn die meisten Versicherungsgesellschaften bei einem Unternehmenskauf die Verträge übernehmen, kann es sein, dass Sie einen höheren Selbstbehalt zahlen müssen oder dass bestimmte Risiken nicht mehr abgedeckt werden.

Agreeing on a non-competition clause

Wenn Sie sich dafür entscheiden, ein Unternehmen zu kaufen, ist es wichtig, ein Wettbewerbsverbot mit dem Verkäufer zu vereinbaren. Dies verhindert, dass der Verkäufer nach dem Kauf des Unternehmens in Konkurrenz zu Ihnen treten kann. Es ist auch ratsam, dies in Ihrem Kaufvertrag festzulegen. Dieses Verbot sollte für einen bestimmten Zeitraum gelten und wird ohne Ausgleichszahlung mit 2 Jahren als umsetzbar angesehen. Manchmal ist es empfehlenswert, auch Familienangehörige des Verkäufers in das Verbot zu integrieren.

Haftungsansprüche

Wenn Sie ein Unternehmen kaufen, übernehmen Sie auch die Haftung für alle Ansprüche, die gegen das Unternehmen vor dem Kauf entstanden sind. Diese Ansprüche können finanziellen oder anderen Charakter haben. Beispielsweise kann ein Kunde einen Schadenersatzanspruch geltend machen, weil er mit einem Produkt des Unternehmens nicht zufrieden war. Auch wenn der Kunde den Schaden erst nach dem Kauf des Unternehmens erlitten hat, haftet der neue Eigentümer für den Schaden. Dies kann über Garantieregelungen und Haftungsklausel im Kaufvertrag zulasten des Verkäufers geregelt werden.

Liabilities

In der Regel existieren Verbindlichkeiten, die das Unternehmen eingeht, um seine Geschäfte zu betreiben. Diese können beispielsweise Kredite, Mietverträge oder Lieferantenrechnungen sein. Wenn Sie ein Unternehmen kaufen, sollten Sie sich daher immer auch über seine Verbindlichkeiten informieren. Denn diese können das Risiko eines Unternehmenskaufs erhöhen.

Tax liabilities

Wenn Sie ein Unternehmen kaufen, findet auch eine Übernahme der Steuerschulden statt. Dies bedeutet, dass Sie für alle offenen Rechnungen und Steuern, die das Unternehmen noch nicht bezahlt hat, verantwortlich sind. Daher ist es wichtig, vor dem Kauf eines Unternehmens genau zu prüfen, welche Steuerschulden das Unternehmen hat und ob Sie diese übernehmen können. Auch hierzu gilt es Garantie- und Haftungsregelungen zulasten des Verkäufers zu vereinbaren.

Business acquisition advice

Ein erfahrener M&A-Berater kann Ihnen dabei helfen, sich auf den Kauf vorzubereiten und die bestmögliche Strategie für Ihr Unternehmen bzw. für sich persönlich zu entwickeln. Die Beratung umfasst in der Regel eine ausführliche Analyse des zu kaufenden Unternehmens, einschließlich einer Ermittlung des Unternehmenswerts, einer Überprüfung der strategischen Alternativen und einer Risikoanalyse.

Ein M&A-Berater hat in den Verhandlungen mit dem Verkäufer die Aufgabe, das Verhältnis zum Käufer unbelastet zu halten und übernimmt die Rolle des kritischen Fragers und Kaufbegleiters.