A successful business succession requires careful planning and preparation. Up to 85 % of the sale proceeds can be tax-free. We explain how this regulation works and which steps are necessary for it.

Read shortly

- What you need to consider when structuring the transfer of a business for tax purposes.

- Which regulations have to be taken into account when transferring a business.

- What tips you can consider.

Table of contents

Tax structuring of business succession

Regulations on the taxation of company successions

Determining the tax value of your business

Tax structuring of business succession

The tax structuring of business succession is an important factor for many entrepreneurs and heirs when planning the transfer of business assets. In this context, various aspects must be considered, such as business assets and the Regelverschonung.

Zusätzlich muss berücksichtigt werden, ob eine Business succession bereits zu Lebzeiten in Form einer Schenkung oder nach Ableben in Form eines Erbes erfolgen soll.

If a business is transferred as a gift or inheritance, gift or inheritance tax must be paid. The amount of tax depends on the value of the business and the degree of kinship of the recipient.

In order to reduce the tax burden, there are various possibilities for tax structuring. One possibility is to make use of the Regelverschonung. This makes it possible to transfer part of the business assets tax-free if certain criteria are met.

What are business assets?

Operating assets include all assets that are used in the context of a business and thus serve to generate income. These include, among other things, land, buildings, machinery and inventories. When transferring business assets to a successor generation, tax aspects must be taken into account in order to achieve an optimal design of the transfer.

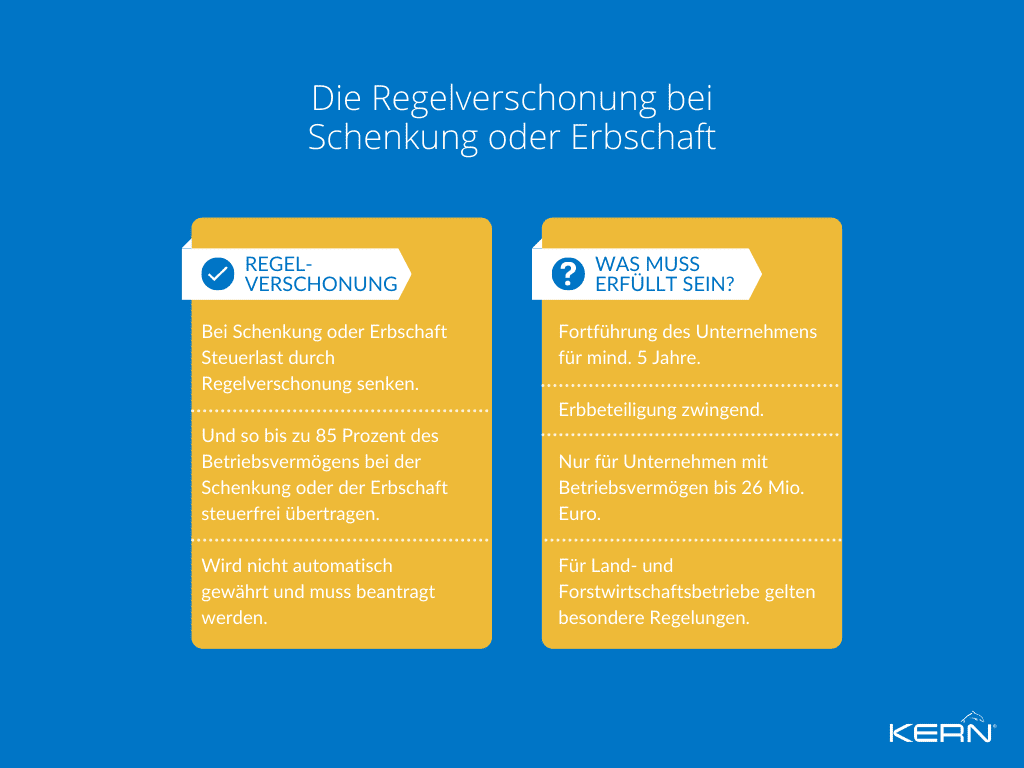

Regelverschonung: Business succession tax-free

The standard exemption allows up to 85 percent of the business assets to be transferred tax-free in the case of a business succession. However, this requires that the transferred business assets continue to be used in the business for at least five years and that the business is not sold in the following seven years.

The Regelverschonung is an important factor in the tax structuring of business succession and can help to ensure that the transfer is economically viable for the heirs.

In order to benefit from the Regelverschonung, the following criteria must be met:

- Continuation of the company: Business assets must be used in the business for at least 5 years, no sale or dissolution of the business (except for compelling reasons such as serious illness of the heir).

- Involvement of the heir: The acquirer must have a direct or indirect interest (direct = run the business itself, indirect = interest in partnership that runs the business).

- Size of the company: Standard exemption only applicable to companies with business assets of up to €26 million. Special requirements are necessary for companies with higher business assets.

- Special regulations: GmbH or GmbH & Co. KG must fulfil certain requirements, special regulations apply to agriculture and forestry.

If these criteria are met, the Regelverschonung can be applied to the transferred business assets. It should be noted, however, that the Regelverschonung is not granted automatically. The acquirer must apply for it and prove that the requirements are met.

The standard exemption can lead to considerable tax savings. By means of an exemption discount of 85 % on the taxable acquisition, a part of the business assets can be transferred tax-free.

Inheritance tax decreases considerably, as the example of a 1 million euro business asset shows: without standard exemption it would be 300,000 euros, with standard exemption only 45,000 euros. Early advice from a tax adviser or specialised tax adviser Company succession lawyer is recommended.

What is the allowance for inheritance tax?

Inheritance tax is usually due when a business is transferred to an heir. However, there is a standard exemption which transfers a certain part of the business assets tax-free. The tax-free part of the business assets is referred to as “special business assets”.

If an entrepreneur transfers his business assets worth 1 million euros to a successor, the standard exemption can be applied. In the example given, 85 % of the business assets can be transferred tax-free, i.e. 850,000 euros. Inheritance tax is only calculated on the remaining amount of 150,000 euros.

To calculate inheritance tax, the tax-free amount of 400,000 euros is deducted from the total assets, including the special business assets. The deduction amount of 150,000 euros is deducted from the taxable assets, so that inheritance tax is only calculated on the remaining amount of 0 euros. This means that in this example no inheritance tax has to be paid.

Regulations on the taxation of company successions

What is the tax rate for inheritance tax?

Inheritance tax is one of the most important taxes in connection with a business succession. The tax rate depends on various factors, such as the value of the inherited assets and the degree of relationship between the testator and the heirs.

Basically: The higher the value of the inherited property and the further apart the degree of kinship between the testator and the heirs, the higher the tax rate.

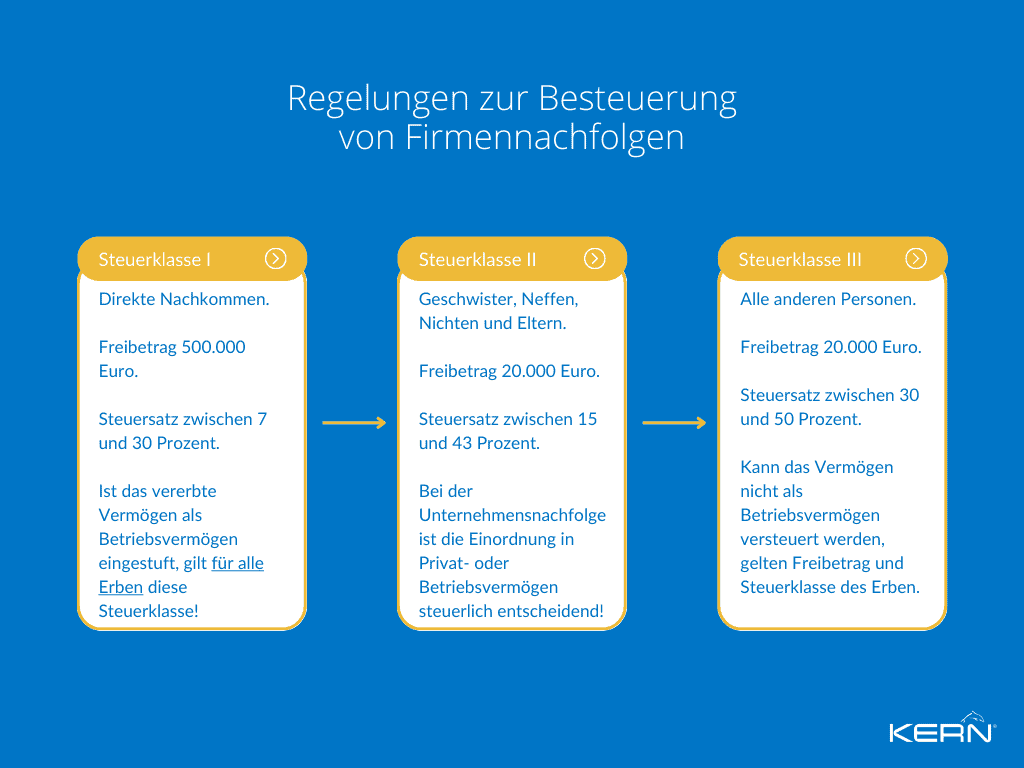

Currently, there are three in Germany Tax brackets for inheritance tax:

- Tax class I: These are direct descendants, i.e. children, grandchildren, spouses and registered partners. The tax-free amount is 500,000 euros and the tax rate starts at 7 % and rises to 30 %, depending on the value of the inherited assets.

- Tax class II: This includes siblings, nephews, nieces, parents and grandparents. The tax-free amount is 20,000 euros and the tax rate starts at 15 % and rises to 43 %, depending on the value of the inherited assets.

Tax class III: These are all other persons, i.e. also unrelated heirs. The tax-free amount is 20,000 euros and the tax rate starts at 30 % and rises to 50 %, depending on the value of the inherited assets.

Which tax bracket applies in the case of a business succession?

If the inherited assets are classified as business assets, tax class I applies to the heirs regardless of the degree of relationship. However, the business must be continued for a certain period of time in order to benefit from this regulation.

If, on the other hand, the inherited assets are classified as private assets, the usual inheritance tax regulations apply and thus also the corresponding tax classes.

In summary, it can be said that in the case of a business succession, the classification of the inherited assets as business assets or as private assets is decisive for the tax class.

If the inherited assets are classified as business assets, tax class I always applies. Otherwise, the tax depends on which tax class the heir belongs to and how high the value of the inherited assets is. Tax class I has a higher tax-free allowance and lower tax rates compared to tax classes II and III.

Determining the tax value of your business

When it comes to the regulations on the taxation of company successions, the tax value of the company also plays an important role. The tax value of the company is the value used for tax purposes to calculate the amount of inheritance tax.

There are various methods for determining goodwill, which can vary depending on the effort involved and the sound, resilient determination.

- IDW S1 procedure: The IDW S1 method is the authoritative method in business valuation. It determines a comprehensible and verifiable value of the company. The appraisal is court-proof and recognised.

- Multiplier method: This method uses a multiplier based on a comparison with other companies in the industry. The multiplier is applied to the company’s profit (usually set at EBIT) or turnover to determine the company’s value.

- Substance value method: This method is based on the calculation of the value of all assets of the company minus all debts and liabilities. The resulting value gives the enterprise value. This is especially useful for companies that do not generate high earnings but have immense fixed assets.

- Sector-specific methods: There are additional industry-specific methods for determining the value of a company based on the specific circumstances of the industry and the company. n the technology industry, for example, the discounted cash flow (DCF) method can be used to determine the value of future expected cash flows. In the retail industry, on the other hand, factors such as sales per square metre, customer base and brand awareness are used to assess the value of retail businesses. In the medical and healthcare industry, metrics such as the number of patients, revenue growth and efficiency of medical services can be used in the valuation.

Enterprise value calculator: A business value calculator can help estimate the value of your business by taking into account various factors such as turnover, EBITDA, equity and growth potential. However, the result tends to be disallowed by a tax authority.

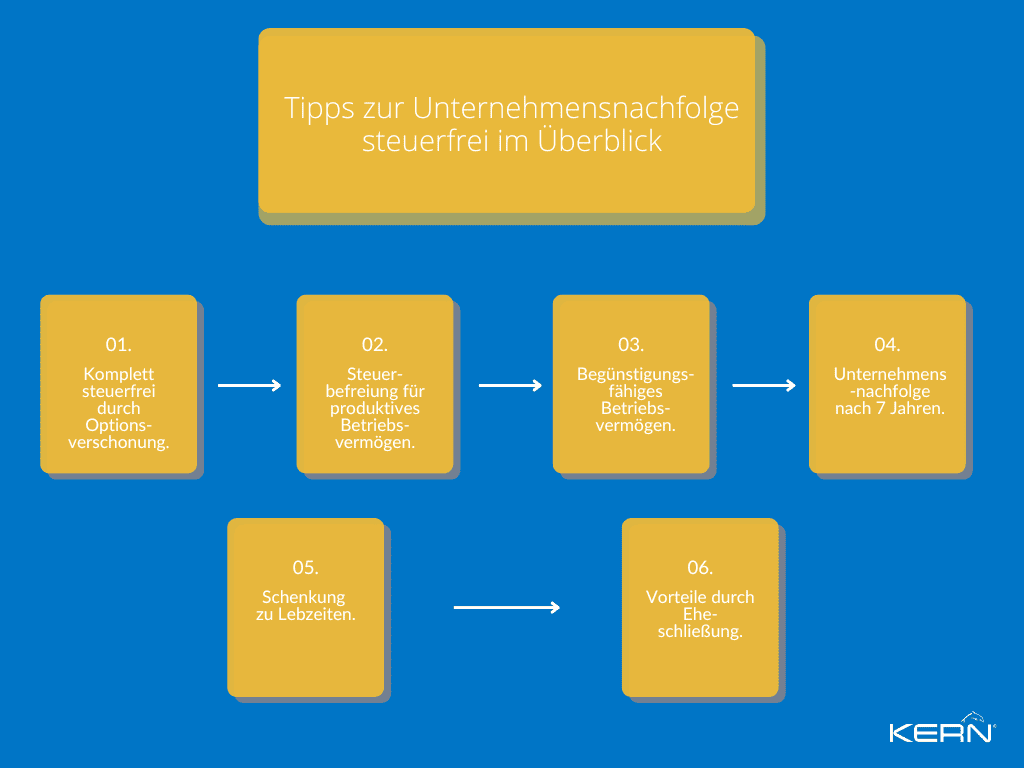

6 Tips for saving taxes

Company succession is an important step in the development of a company. However, there are also some tax pitfalls to be aware of. In the following, you will find some tips on how you can save taxes during business succession. From option exemption to lifetime gifts, there are various ways to reduce the tax burden and ensure a smooth transition of the business. However, it is important to plan early and carefully and seek expert advice to minimise tax risks.

1. Completely tax-free: Option exemption

Option relief is an attractive option for the tax-free transfer of business assets to the next generation, but requires certain conditions. The assets must remain in the business for at least seven years and be used productively. The scheme can also be used for the transfer of shares in corporations, but different rules apply. If the conditions are met, up to 100 per cent of the business assets can be transferred tax-free.

2. Tax exemption for productive business assets

Productive business assets that the business successor uses for at least five years can also be transferred tax-free. However, there is an upper limit of 5 million euros that may not be exceeded.

3. eligible business assets

There are also tax advantages in the preferential treatment of business assets. For example, assets eligible for preferential tax treatment, such as business property or owner-occupied residential property, are only partially taxed.

4. Company succession after 7 years

Early planning for business succession is crucial in order to take advantage of tax benefits. Ideally, you should start planning seven years before the planned transfer. This is because it is only from this point in time that the business assets are tax-privileged and allowances can be used. Early planning also gives you the opportunity to transfer the business assets to the next generation in time to reduce the tax burden.

5. Donation during lifetime

A gift during one’s lifetime can be an attractive way to save taxes on business succession. However, it should be noted that certain tax-free amounts may not be exceeded.

6. Advantages through marriage

Marriage can also offer tax advantages for business succession. Here, for example, there is an allowance for the spouse that can be used when transferring the business assets. In addition, a prenuptial agreement can help to avoid tax pitfalls and to structure the succession of assets. However, it is important to seek advice from a tax advisor or lawyer in order to understand the tax possibilities and risks involved in a marriage.

Conclusion

The tax structuring of business succession is an important factor when planning the transfer of business assets. Various aspects have to be taken into account, such as business assets and the Regelverschonung.

The Regelverschonung allows up to 85 percent of the business assets to be transferred tax-free in the case of a business succession. However, the transfer must meet certain criteria, such as the continuation of the business and the size of the business.

The Regelverschonung can help to ensure that the transfer is economically viable for the heirs. Tax planning for business succession is complex and requires careful planning and advice from professionals such as the experts at KERN.

Frequently asked questions

The tax-free allowance for business succession is a tax benefit granted when a business is transferred to an heir or successor. The tax-free amount in Germany is currently up to 500,000 euros per inheritance and up to one million euros in the case of transfer to spouses or registered civil partners.

Inheritance tax can be reduced in various ways, for example by making gifts during one’s lifetime, using allowances, setting up foundations or transferring assets to beneficiaries. However, it is important to note that each of these methods comes with certain limitations and conditions, and that professional advice can help in choosing the best strategy.

Inheritance and gift tax rates vary according to the degree of kinship between the testator or donor and the recipient. In Germany, the tax rate for direct descendants, i.e. children and spouses, is up to 30 %, while more distant relatives and non-relatives can be taxed up to 50 %.

Inheritance tax is due when assets pass to a person’s heirs after death. Gift tax, on the other hand, is due when assets are given away during a person’s lifetime. An important difference between the two types of tax is that with inheritance tax, only one allowance applies to each heir, whereas with gift tax, allowances can only be claimed again every ten years.

The tax exemption is a tax advantage that applies to business succession. It ensures that a portion of the business assets remains tax-free. Depending on the size of the company and the duration of the transfer, up to 100 per cent of the business assets can benefit from the tax relief.